How to Read Your Earnings Statement

1. Period Beginning, Period Ending, and Pay Date

- For hourly staff and students the beginning date will be the Saturday following the prior period end date. The Ending date will always be a Friday. This is a two-week period.

- Faculty and administrators are paid "to date" and the period end date will either be the 15th or the last day of the month (corresponding to our semi monthly pay schedule)

- If you need to review the pay schedules you can do so here (schedules/schedules.html)

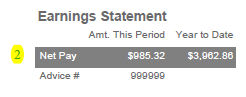

2. Net Pay and Advice Number

This section reports your net pay for the period as well as calendar year to date.

The advice number for pays directly deposited will begin with 9xxxxx (see Deposit

Information section for details).

The advice number for pays that were issued by check will begin with 3xxxxx.

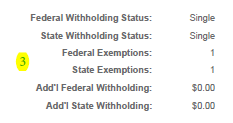

3. Tax Status

This section identifies your Tax withholding status and number of allowances plus if any additional withholding was requested.

Note: If you checks the "Married, but withhold at the higher Single rate" on your tax withholding form, this will appear simply as "Single".

4. Earnings

![]()

This section lists your Earnings. Each type will be on a row. If hours and rate apply, it will be listed. This period lists gross amount and Year To Date total gross by earn type for the current calendar year. The total gross pay is totaled at the bottom of the section.

5-7. Taxes, Benefits, and Other Deductions

![]()

This sections reports each tax and deduction. The employee column is what was withheld or deducted in the current pay. The employee year to date column totals pay dates in the current calendar year. The grey columns are the amounts Loyola paid in the current period and calendar year to date. The Applicable Gross Column is the calculated amount that is taxable for each tax type and eligible gross for each benefit or deduction.

Note: The amounts in the applicable gross column (7) for taxes will be less than gross wages as many benefit deductions are pre-tax. ie. 403(b) deductions are not subject to Federal or Maryland State Tax. Health Insurance deductions are not subject to Medicare, Social Security, Federal, or Maryland State taxes.

8. Deposit Information

![]()

This section details the breakdown of the deposit of your net pay. Bank Name, last 4 digits of your account number, and amount deposited are listed as well as total if more than one account.

9. Leave Used

![]()

The Leave Used (in Hours) section details your leave plans, hours used in current period, and remaining balance.

Note: For Administrators, your Web Advisor leave balance is the most up to date since leave used is processed by Benefits.

10. Taxable Fringe Benefits

![]()

This section details Taxable Fringe Benefits. The amounts in the current column are included in the Applicable Gross (7) amount but not deducted from your pay.

Note: Life Ins & AD&D taxable fringe benefit amount is the Group Term Life reported on your W-2 Box 12 Code C.